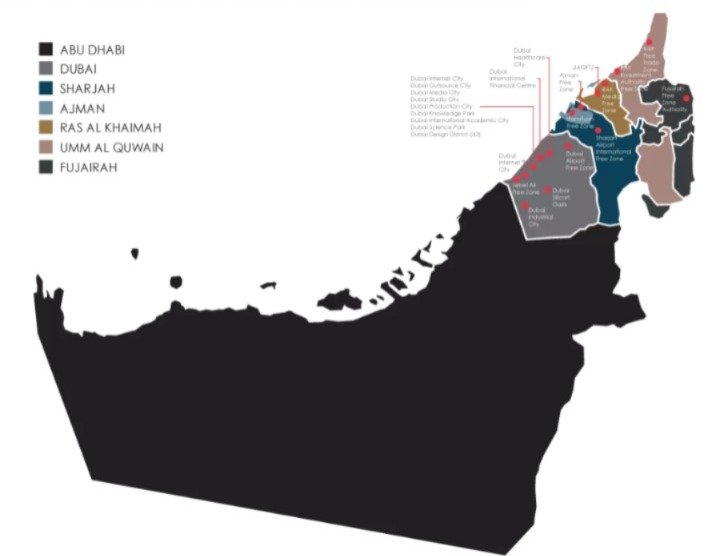

Dubai is renowned for its many Free Zonesspecial economic zones that offer significant fiscal and operational advantages for companies. These zones are designed to attract foreign investment and promote economic development. Some of the main ones are listed below Free Zones of Dubai and the advantages they offer.

Main Free Zones of Dubai

1. Jebel Ali Free Zone (JAFZA)

- DescriptionJAFZA is one of the largest and most popular Free Zones in Dubai, located near the port of Jebel Ali.

- Advantages:

- 100% foreign-owned.

- No corporate income tax for 50 years, renewable.

- No capital gains tax.

- Direct access to the port of Jebel Ali, facilitating import/export operations.

2. Dubai Multi Commodities Centre (DMCC)

- Description: DMCC is a Free Zone dedicated to the trade of goods and commodities, such as gold, diamonds and precious metals.

- Advantages:

- 100% foreign-owned.

- No income tax for 50 years.

- Modern infrastructure and support services for companies.

- A favourable environment for trading and logistics activities.

3. Dubai Internet City (DIC)

- DescriptionDIC is a Free Zone focused on information and communication technologies.

- Advantages:

- 100% foreign-owned.

- No income tax for 50 years.

- Access to a network of professionals and technology companies.

- High-quality infrastructure and support for innovation.

4. Dubai Healthcare City (DHCC)

- DescriptionDHCC is a Free Zone dedicated to the health and life sciences sector.

- Advantages:

- 100% foreign-owned.

- No income tax for 50 years.

- Access to a network of professionals and institutions in the health sector.

- Modern infrastructure and support services for companies.

5. Dubai Airport Freezone (DAFZ)

- Description: Located close to Dubai International Airport, DAFZ is designed for logistics and air transport companies.

- Advantages:

- 100% foreign-owned.

- No income tax for 50 years.

- Direct access to the airport to facilitate import/export operations.

- Support services for companies in the logistics sector.

6. Dubai Silicon Oasis (DSO)

- DescriptionDSO is a Free Zone dedicated to advanced technologies and innovation.

- Advantages:

- 100% foreign-owned.

- No income tax for 50 years.

- Modern infrastructure and support for technology start-ups.

- A favourable environment for research and development.

7. Dubai Media City (DMC)

- DescriptionDMC is a Free Zone focused on media and communication.

- Advantages:

- 100% foreign-owned.

- No income tax for 50 years.

- Access to a network of media professionals and companies.

- High-quality infrastructure and support for creativity.

General Advantages of Dubai Free Zones

- 100% Foreign OwnershipInvestors can fully own their companies without the need for a local partner.

- Tax ExemptionsNo tax on income, capital gains or imports for an extended period, usually 50 years.

- Ease of Establishment: The procedures for registering and setting up a company are simplified and fast.

- Access to Global MarketsDubai Free Zones offer direct access to international markets, facilitating trade and commerce.

- High Quality InfrastructureFree Zones are equipped with modern infrastructure and support services that facilitate business operations.

The Free Zones of Dubai represent a unique opportunity for investors wishing to start or expand their businesses in a favourable and dynamic environment. With significant tax advantages and a high-quality infrastructure, Dubai continues to position itself as a global hub for business and innovation.

The Dubai Free Zones, while offering similar tax advantages, differ from each other in some key aspects:

Areas of Specialisation

Each Free Zone focuses on specific industrial or commercial sectors:

- JAFZAlogistics, trade, manufacturing

- DMCC: trade in precious metals and diamonds

- Dubai Internet City: technology and telecommunications

- Dubai Healthcare City: health and life sciences

- Dubai Design District: design, fashion, luxury

Geographical Localisation

Free Zones are strategically distributed in different areas of Dubai:

- JAFZA: near the port of Jebel Ali

- Dubai Media City: in Dubai Media City

- Dubai Silicon Oasis: in Dubai Silicon Oasis

- Dubai Airport Freezone: near Dubai International Airport

Location influences access to specific infrastructure such as ports, airports and transport networks.

Licence Requirements

Some Free Zones have more specific licensing requirements depending on the sector:

- DMCC: requires a commercial licence to trade in precious metals and diamonds

- Dubai Healthcare City: requires health licences for medical activities

- Dubai Media City: has licensing requirements for media-related activities

Services and Infrastructure

Free Zones offer services and infrastructures adapted to the relevant sectors:

- Dubai Design District: provides workspaces and showrooms for design companies

- Dubai International Academic Cityhosts universities and institutes of higher education

- Dubai Science Parkoffers laboratories and facilities for scientific companies

Capital Requirements

Some Free Zones may have minimum share capital requirements for registering a company:

- DMCC: requires a minimum share capital of AED 50,000 (approx. € 12,000)

- DAFZArequires a minimum share capital of AED 10,000 (approx. € 2,500)

While all Free Zones offer similar tax and operational advantages, the choice of the most suitable zone depends on the business sector, geographic location and specific services required by the company. Investors should carefully consider which Free Zone best suits their unique needs.

If you are interested in exploring investment opportunities in Dubai or you would like more information on tax advantages and the tourism sector, please do not hesitate to contact us. Our experts are ready to provide you with personalised advice and guide you on your investment journey in Dubai.

Contact us today to find out how we can help you realise your goals in the city that never ceases to amaze!